Funding a house purchase is difficult ample without receiving misplaced inside the jargon. This is a cheat sheet that may help you keep track of the conditions.

The conforming loan limit on your region determines the boundary between when a conforming standard loan turns right into a jumbo loan, which demands a larger sized deposit and normally has a greater curiosity level.

For example, when these regulators evaluate an institution’s reasonable lending possibility, they review HMDA data together with other info and chance things, in accordance With all the Interagency Good Lending Evaluation Procedures

Choose ranked the five best house loan lenders for borrowers in a variety of situation, for instance Rocket Mortgage getting a good healthy for borrowers with reduced credit score scores and SoFi as the ideal for conserving cash.

The FHA loan limit for very low-Value regions is ready at 65% with the conforming loan Restrict, which is better in areas where properties are costlier. To account for the upper expense of development in spots like Hawaii or Alaska, FHA loans issued in Individuals locations have their own personal Particular restrictions.

Here's how you already know Official Sites use .gov A .gov Site belongs to an official govt Business in The us.

Borrowers can anticipate better limits for conforming standard loans and FHA loans in 2023.

Due to this fact, it's always easier for borrowers to qualify for an FHA loan than for a standard or conforming loan. When you've got difficulties with your credit history, you may typically obtain it less difficult to acquire an FHA loan.

Editorial Be aware: Thoughts, analyses, assessments or suggestions expressed in this post are All those of the Pick editorial staff members’s on your own, and have not been reviewed, accredited or normally endorsed by any third party.

Find independently decides what we address and advise. We get paid a Fee from affiliate associates on several features and inbound links.

In the event your spending budget for purchasing a home was near the 2022 restrictions for FHA or conforming loans, you may be able to choose out a larger loan without having resorting into a jumbo loan (which is frequently more expensive and more durable for being authorised for).

The ideal property finance loan for yourself is determined by your individual economical circumstance, the kind of property, along with other aspects, including where by the house is found.

Within a very hot property marketplace exactly where sellers obtain many presents, it could be difficult to get a proposal approved with a FHA loan. Traditional loans are generally far more attractive to sellers as they are looked at as remaining less difficult to deal with.

One particular benefit of FHA loans is that they are easier to qualify for, especially if you do have a lower credit score score. For borrowers with normal credit history, you're likely to find the house loan level and month-to-month insurance policies premiums tend to be more fair having an FHA loan.

HMDA facts are generally not utilized alone to determine no matter whether a lender is complying with truthful lending legislation. The information will not include some legitimate credit risk factors for loan approval and loan pricing more info conclusions.

Danica McKellar Then & Now!

Danica McKellar Then & Now! Nancy Kerrigan Then & Now!

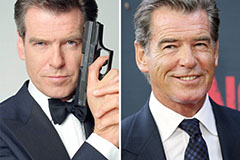

Nancy Kerrigan Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!